“Such a tax on the wealth of America’s richest universities could create huge benefits for our society (at least if the revenue is spent properly)”

The latest proposal by Trump and Republicans to tax ultra-rich colleges’ endowments is overall a terrible idea. While it does get some things right, Congress should resoundingly reject this in favor of a much better endowment tax with all of the good and none of the bad.

But what does the Republican endowment tax do right?

First, it gets points just for being an endowment tax. Such a tax on the wealth of America’s richest universities could create huge benefits for our society (at least if the revenue is spent properly).

Relatedly, the Republican endowment tax is structured to tax universities based on endowment money per student, not just based on their wealth alone: this way, rich colleges with very small student populations will get taxed more than rich colleges with larger student populations. This way, very wealthy schools will have a greater incentive to accept more students if they want to get taxed less.

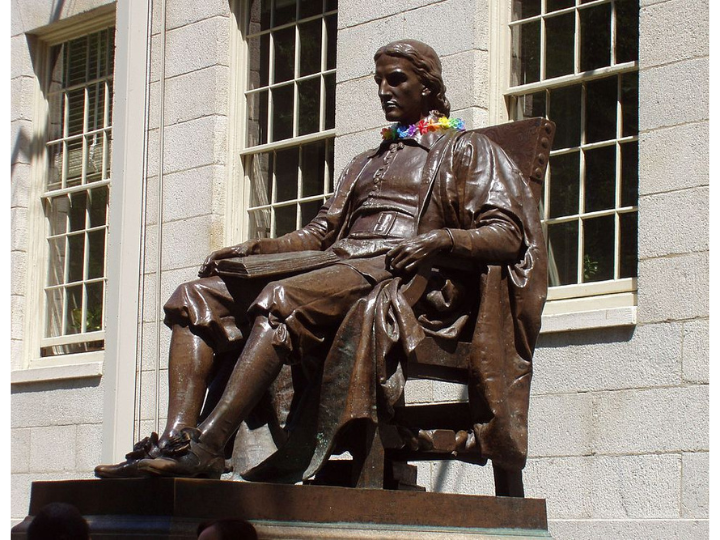

This kind of endowment tax is just what we need to hold Harvard University and other ultra-rich universities accountable for refusing to use their unfathomable wealth to educate more Americans.

Serving the public interest means providing opportunities to as many people as possible. So why do universities wealthier than entire countries only accept 3 percent of applicants yet expect to be tax-exempt?

Harvard’s own students gripe that the university’s student population has barely grown over the last 40 years despite becoming eight times richer during the same period. And how did these elite colleges become so rich in just the last few decades? Mostly by engaging in for-profit speculation on Wall Street despite claiming nonprofit status.

Unfortunately, however, there are multiple glaring flaws with Republicans’ proposed endowment tax that completely cancel out the few good parts.

The purpose of any endowment tax should be to fight the nauseating money-hoarding of America’s richest universities and redistribute a small portion of their overflowing coffers to public colleges committed to serving as many students as possible. Trump and Republicans, unfortunately, have given no indication they will use this endowment tax to benefit the American public: just look at their massive cuts to higher education and science funding.

Relatedly, it is impossible to disentangle Trump and Republicans’ proposed tax from their push to punish these universities for supporting students’ free speech and, most recently, for admitting international students. Indeed, the tax only counts domestic students, such that schools with many more international students will be taxed much more as Phillip Levine of Wellesley College notes.

When there is no plan to use this tax to actually benefit American families, it becomes clear that Trump’s endowment tax is more than anything about punishing universities that stand up to him.

In addition, there is the question of whether this endowment tax would tax elite colleges too much. Up from the original 2017 endowment tax’s 1.4 percent, the highest tax rate of Trump and Republicans’ endowment tax would be 21 percent for colleges such as Harvard and Princeton, which have over $2 million per student. It is important to recognize that even the richest universities can only be taxed so much.

The ideal endowment tax would likely be in the single digits, based on the Endowment Tax proposed in Massachusetts. That bill proposed just a 2.5 percent flat tax on all university endowments which exceed $1 billion. Despite this low rate, this Massachusetts endowment tax, according to its sponsor State Rep. Natalie Higgins, would bring in a whopping $2.28 billion in revenue.

The ideal endowment tax would also have a dedicated purpose for the revenue. For example, Massachusetts’ proposed Endowment Tax Act stipulates that all revenue must go into a trust to be used exclusively for “higher education, early education and child care for lower-income and middle-class residents”.

According to left-leaning policy center MassBudget, the Endowment Tax’s yearly revenue would be more than double the $1 billion a year needed to make all Massachusetts public colleges tuition-free with no strings attached.

While it is likely this underestimates the cost of free public college in Massachusetts – especially since many more people would then enroll once tuition-free – it is clear that all we need is an endowment tax in the low single digits to reap huge benefits for the public.

All the while, it would be harmless to the schools it affects: Harvard’s student newspaper the Crimson noted the university would still add nearly $20 billion to its endowment over a 10-year period even if there were a 2.5 percent tax on its endowment. Evidently, an endowment tax does not have to go beyond the low single digits to reap huge benefits for the American people.

The Republicans’ endowment tax is only admirable in two basic ways: first, because it merely exists as an endowment tax; and second, because it specifically penalizes universities that educate much fewer students relative to their wealth (e.g., Harvard or Amherst College) while rewarding universities that admit more students (e.g., Boston University or NYU).

Nonetheless, the flaws of Republicans’ endowment tax overwhelmingly outweigh its very limited number of strengths: it has questionably high tax rates; has no plan for using the revenue to benefit the public; and is indistinguishable from Trump and Republicans’ simultaneous efforts to punish colleges for protecting free speech. We have no reason at all to settle for Republicans’ incredibly dangerous proposal when a much better endowment tax is possible.